Prudent.

Probable.

Predictable.

Strategic Wealth Management Solutions for Growth & Income.

Excellence, Published Nationwide

Our Objective is to Maximize the Upside & Minimize the Downside*

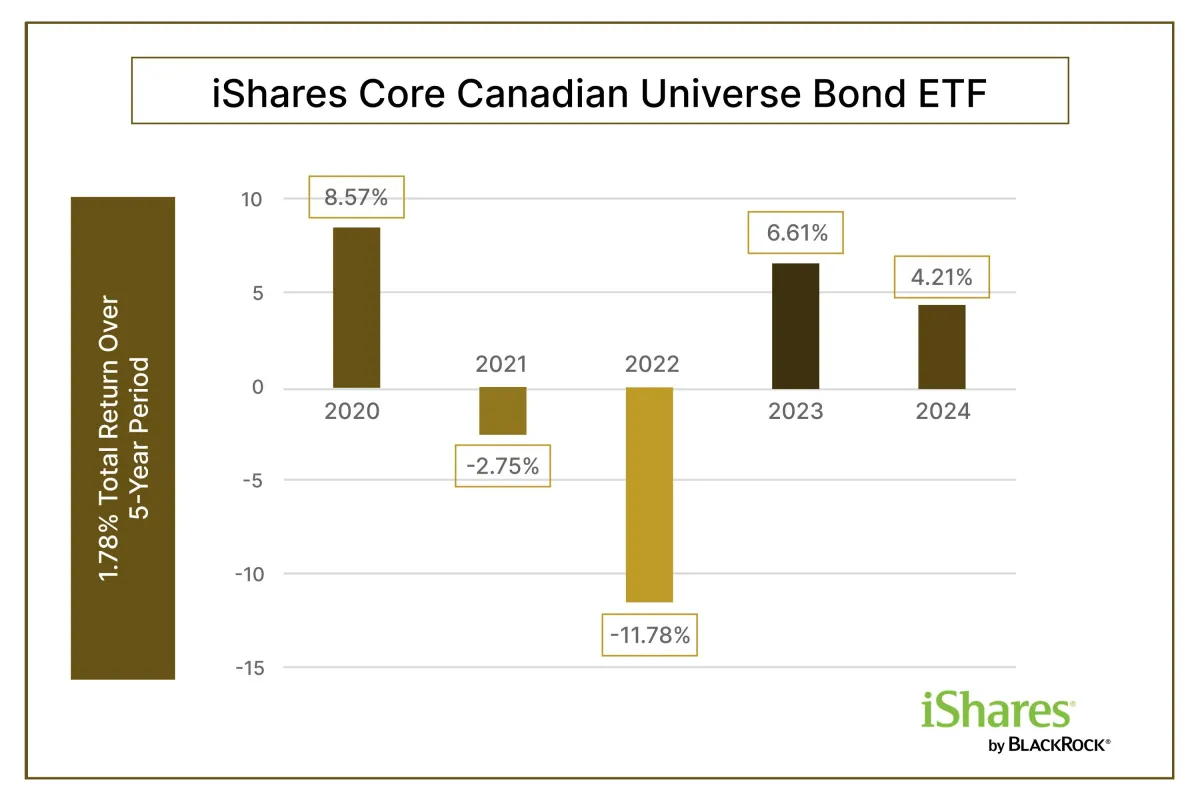

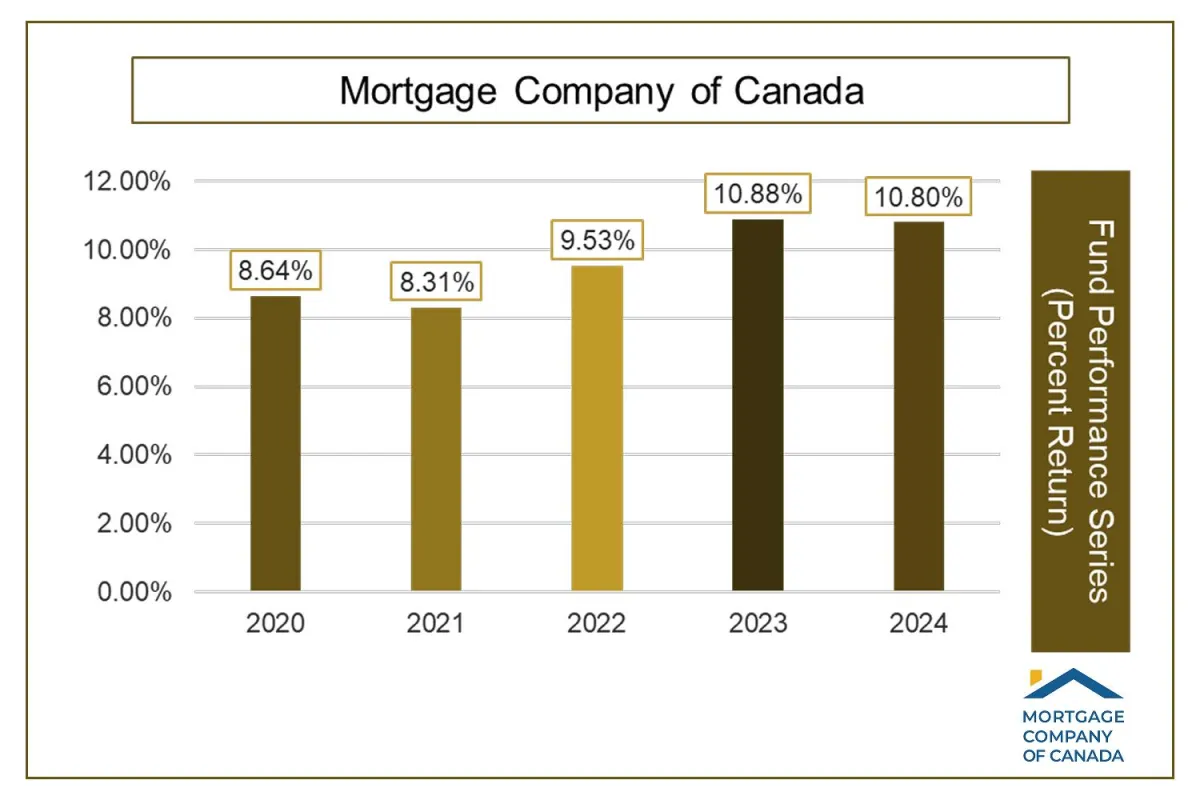

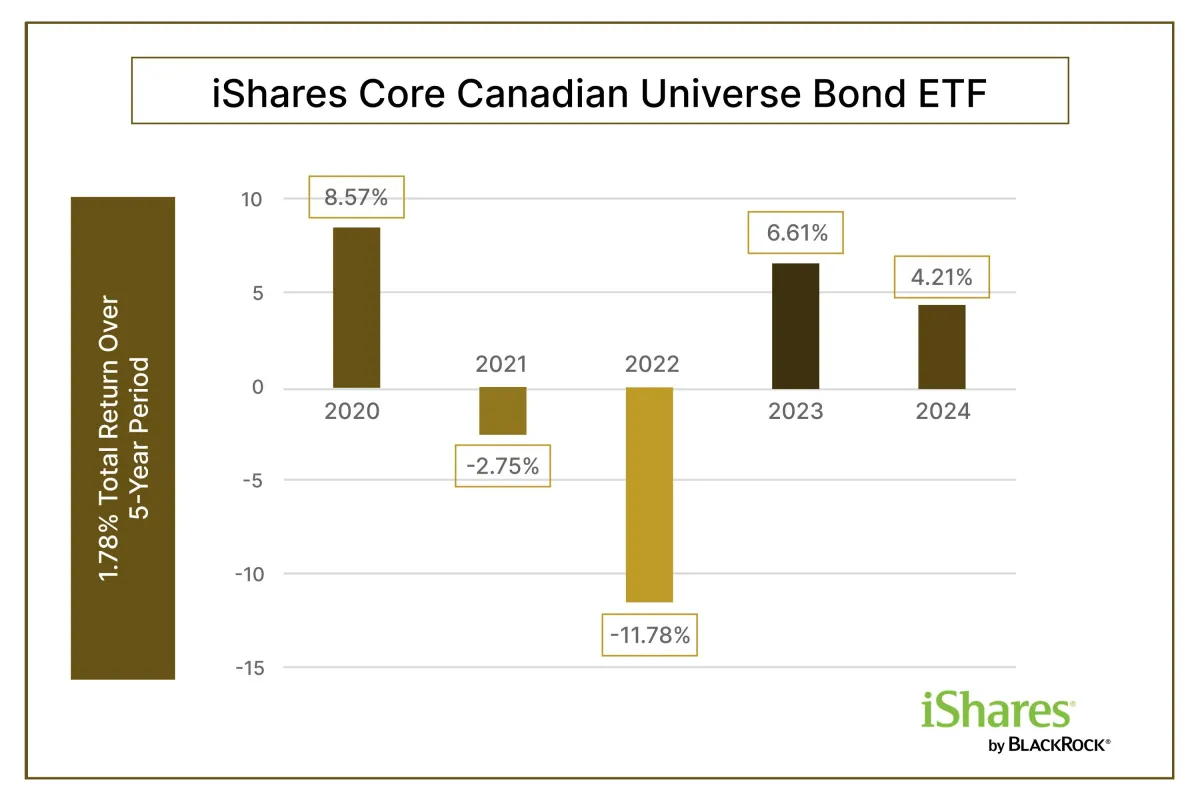

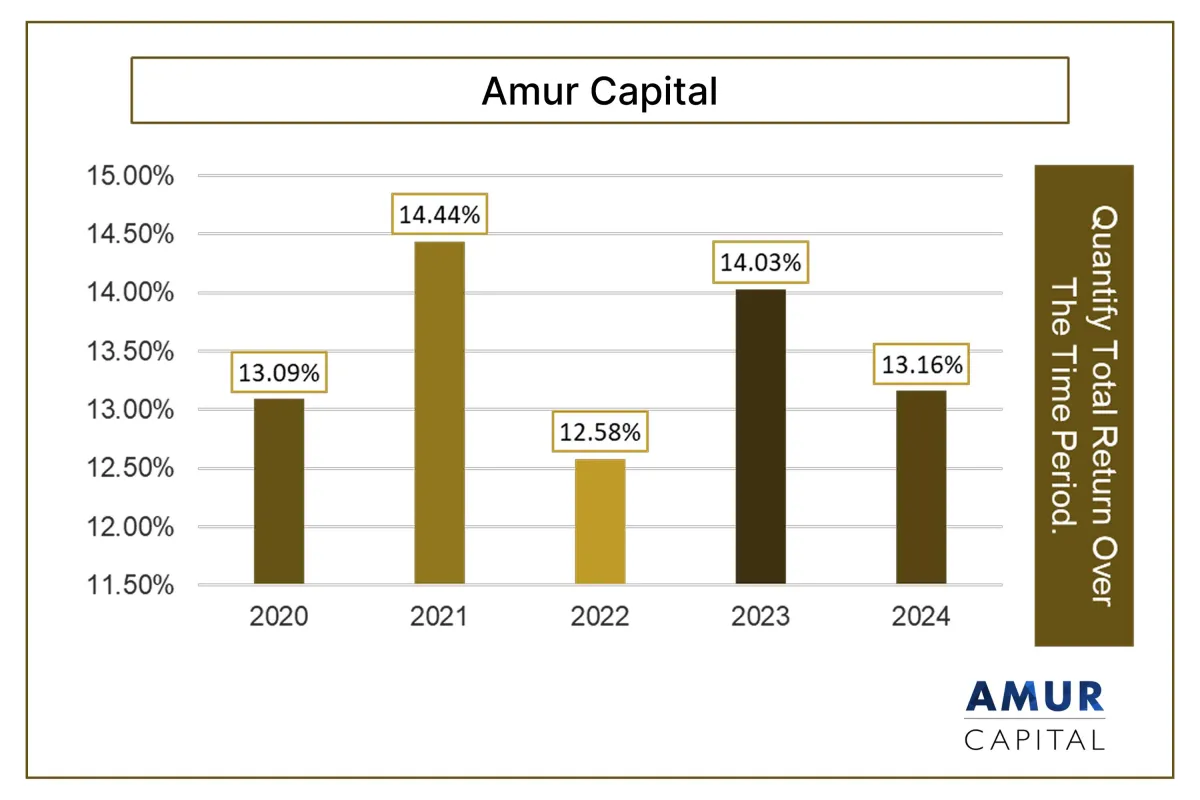

PUBLIC CREDIT VS PRIVATE CREDIT (2020-2025)

A gain of $35,010.96 compared to a gain of $583,377.17 on 1 million invested. Which would you rather have?

PUBLIC CREDIT VS PRIVATE CREDIT (2020-2025)

A gain of $35,010.96 compared to a gain of $880,075.81 on 1 million invested. Which would you rather have?

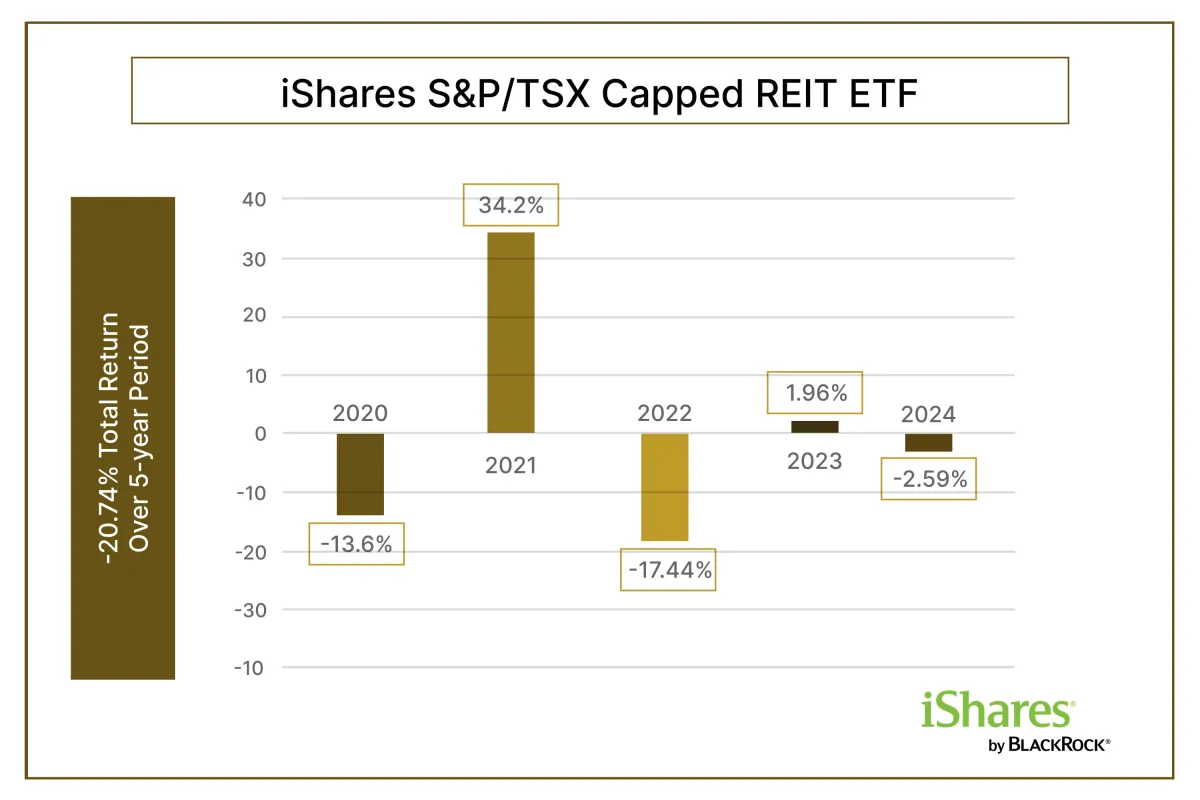

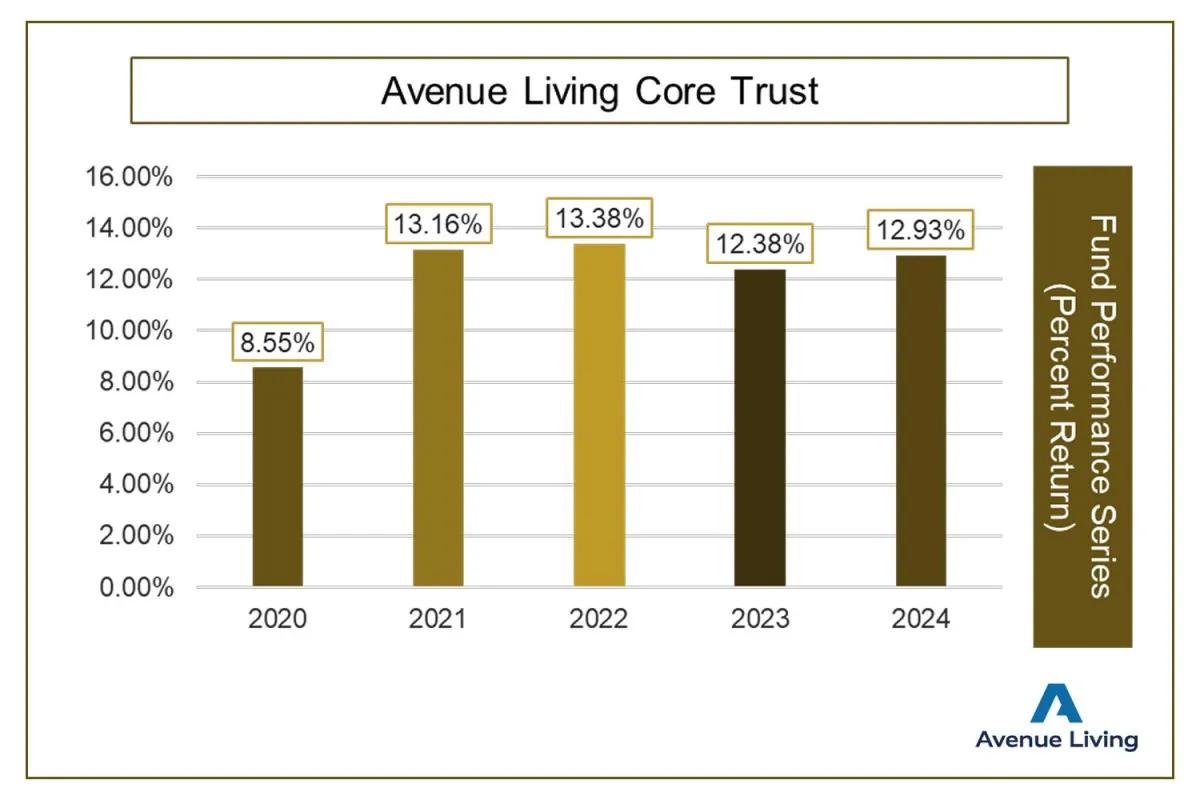

PUBLIC REAL ESTATE VS PRIVATE REAL ESTATE (2020-2025)

A loss of -$49243.48 compared to a gain of $767,492.48 on 1 million invested. Which would you rather have?

In short, market volatility is never going away. Normal stock and bond prices will continue to fluctuate. And emotional sensationalism will continue to endanger your hard-earned capital. Are you ready to benefit from a better way?

*Past performance is not indicative of future results. All investments carry risk, and there is no guarantee that any strategy or investment will achieve its intended results. Travis Forman and his affiliates do not provide any assurance of returns, and individual outcomes may vary based on a range of market and personal factors. It is possible that private securities can have negative or worse returns than the three examples noted above.

Going Private Makes Good Sense

In 2016, Travis Forman made a fundamental shift in his investment philosophy. With interest hikes on the horizon, he knew that unless something was done to avoid the downturn, client portfolios would take a massive hit.

Catapulted by necessity, and the trust of his clients, Travis began to study the investment style of the Canada Pension Plan.

“How is it,” he wondered, “that when the S & P 500 plummets, the Canada Pension Plan still enjoys such high rates of return?”

The answer, he soon found, was in an alternative asset class historically known for its relative stability and predictability, with greater insultation from market swings:

Private Investments.

A Paradigm Shift in Portfolio Construction

Building on this discovery, Travis began working with Willoughby Asset Management to align his clients with a suite of professionally managed funds that included access to private investment opportunities. Once reserved primarily for institutions, these strategies were now being integrated into broader portfolio conversations—opening the door for more Canadians to benefit from a traditionally exclusive asset class.

Your Personal

Prosperity Formula

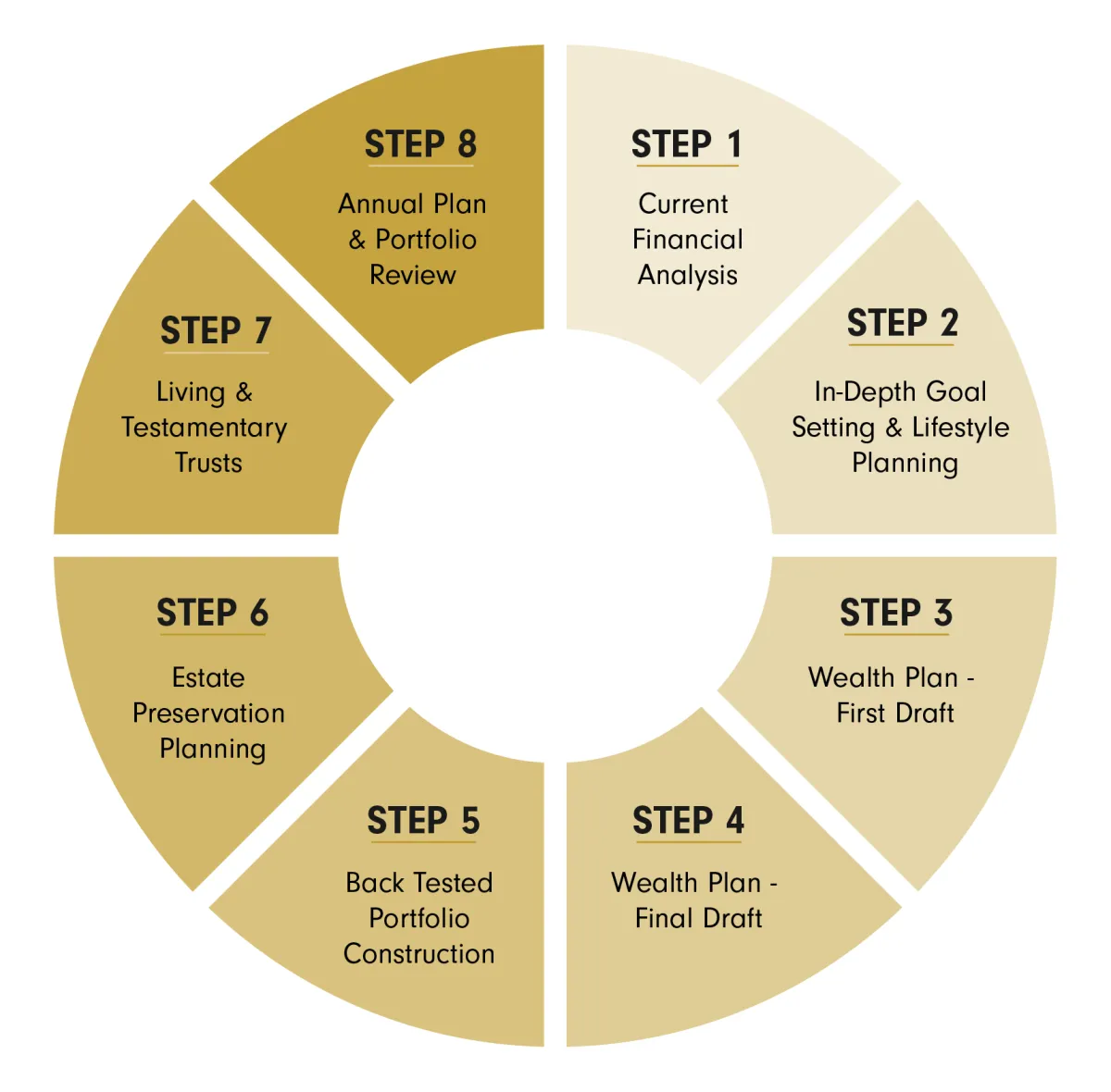

Holistic wealth management, with private investments at the core, is the difference between winning and losing. That’s why, regardless of your investment level, you're entitled to all or part of our integrated, 8-step process to both preserve AND maximize your capital.

Help, Whenever You Need It

Meet the team that treats your investments like their own.

Travis Forman

Senior Portfolio Manager

Gwyneth Quayle

Client Services Manager

Carol Ritchie

Administrative Assistant

Start Now, Stay for Life

In 25 years, across multiple firms, Travis has earned something every advisor wants: long-term trust.

Most clients stay for years. Many, for life.

Heather H.

Lai-Lin & Dimitri

Laurie L.

Contact Us

Travis Forman

#310 15252 32 AVE, SURREY British Columbia V3Z 0R7

(604) 788-8011

© 2026

All Rights Reserved